Phone: +254 700 524589 | +254 782 524589 Email: [email protected]

Unraveling the New NSSF Rates: Ruto’s Government Raises Minimum Monthly Contribution to Ksh 840, Effective February 2024

Introduction

The ever-evolving landscape of financial regulations is set to witness a significant shift as the government, under the leadership of Deputy President Ruto, announces an increase in the minimum monthly contribution to the National Social Security Fund (NSSF). This move, effective February 2024, holds implications for both employees and employers alike. In this article, we delve into the details, implications, and the broader economic context surrounding this decision.

Understanding the NSSF Rate Adjustment

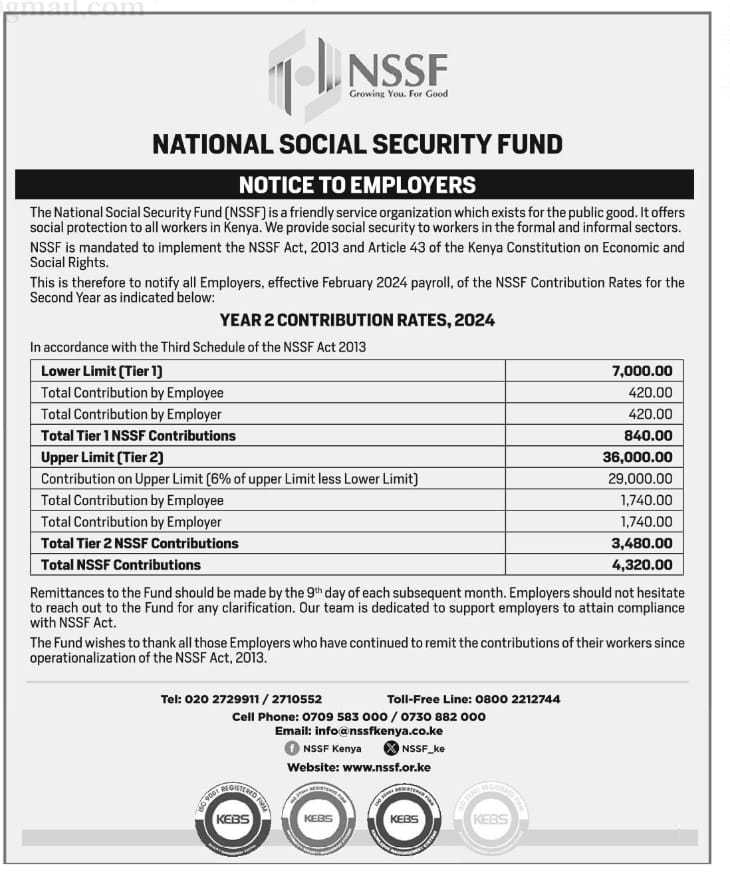

In a bid to bolster social security benefits, the government has raised the minimum monthly contribution to the NSSF to Ksh 840. This adjustment aims to address the evolving needs of the workforce and ensure a robust social safety net for all citizens.

The Numbers Speak

The new contribution rate marks a substantial increase from the previous figure, and it is essential to comprehend the financial implications on both employers and employees. The augmented rate seeks to strike a balance between sustainable social security and individual financial well-being.

Implications of new NSSF rates for Employees

As employees form the backbone of any economy, understanding the impact of this change on their financial dynamics becomes crucial. The augmented NSSF rates will influence disposable income, and employees need to assess how this adjustment aligns with their long-term financial goals.

Balancing Act: Navigating Personal Finances

With the increased monthly contribution, employees are urged to revisit their budgetary allocations and make necessary adjustments. This financial recalibration is essential for maintaining a healthy balance between present needs and future security.

Employers’ Perspectives

Employers, too, will experience a shift in their financial obligations as a result of the revised NSSF rates. It is imperative for businesses to strategize and incorporate this change seamlessly into their payroll processes.

Ensuring Compliance: Navigating the Regulatory Landscape

Staying compliant with the updated NSSF rates is not only a legal obligation but also a testament to a company’s commitment to employee welfare. Businesses must communicate transparently with their workforce, ensuring a smooth transition and fostering a positive workplace environment.

The Economic Context

Understanding the broader economic context surrounding this decision is key to grasping its significance. Deputy President Ruto’s government emphasizes a proactive approach to social security, aligning with global trends that prioritize the financial well-being of citizens.

Global Perspectives: Comparing Social Security Models

Analyzing social security models in other countries provides insights into the efficacy of different approaches. This contextualization helps in understanding where Kenya stands in the global spectrum and sheds light on potential future adjustments.

Conclusion

In conclusion, the adjustment of NSSF rates by Ruto’s government is a noteworthy step towards fortifying social security in Kenya. As we navigate these changes, it is essential for both employees and employers to adapt, ensuring a harmonious transition that supports the overall economic well-being of the nation.

FAQs

- How will the increased NSSF rates impact my take-home pay?

- The augmented rates will result in a decrease in disposable income, necessitating a reassessment of personal budgets.

- Is compliance with the new rates mandatory for employers?

- Yes, adherence to the updated NSSF rates is mandatory for employers to ensure legal compliance and employee welfare.

- Are there any exemptions to the increased NSSF rates?

- The government’s announcement suggests a universal application of the revised rates without specific exemptions.

- Can employees opt-out of the increased NSSF contributions?

- No, the adjustment is a mandatory measure to enhance social security benefits and cannot be opted out of by employees.

- How can businesses communicate the changes to their employees effectively?

- Transparent communication through official channels and documentation is crucial for fostering understanding and compliance among employees.

Do you want help in being compliant on all statutory deductions contact SGB consulting via [email protected]